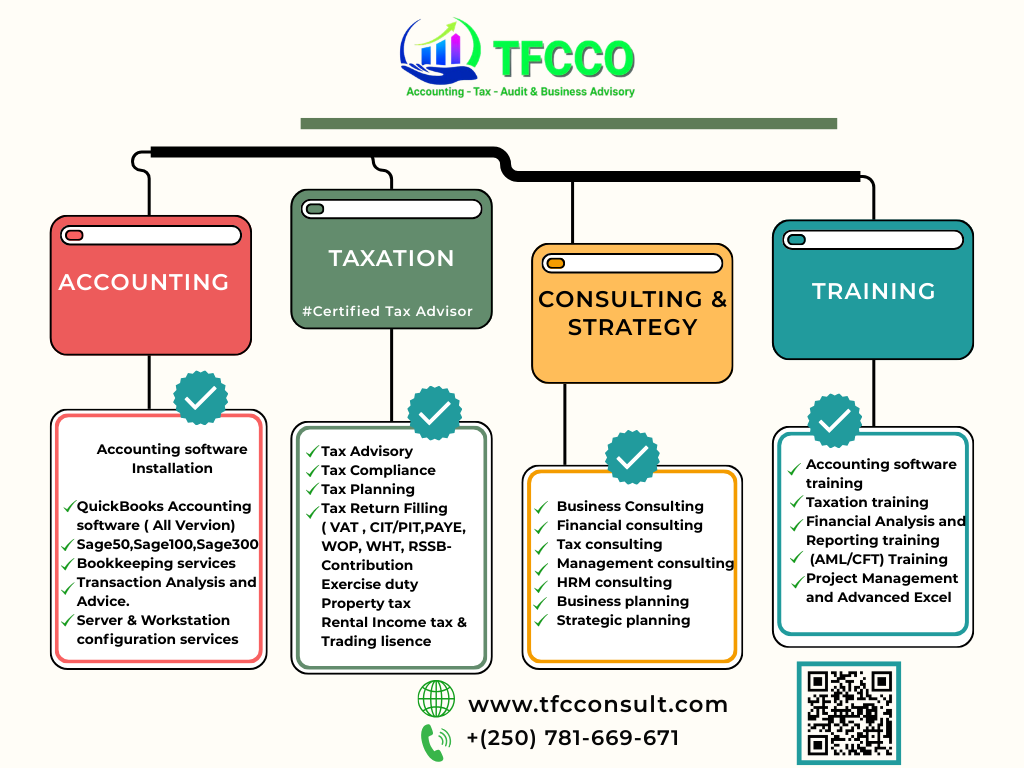

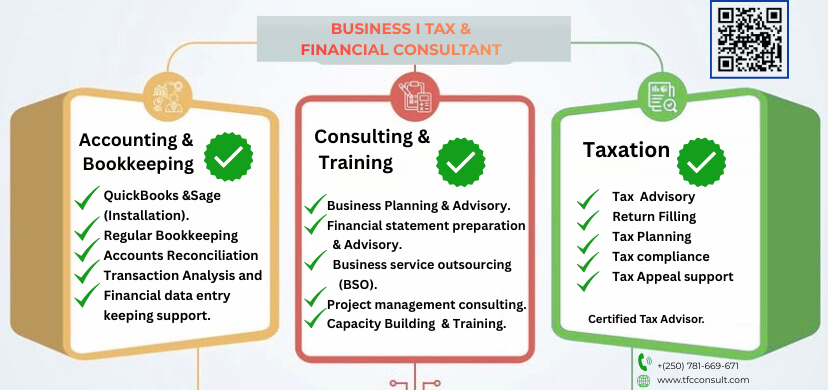

CONSULTANCIES

PROFESSIONAL TRAINING

- Taxation Training

- Accounting Software Training

- Financial Analysis and Reporting Training

- Anti-Money Laundering (AML/CFT) Training

- Project Management and Advanced Excel

ACCOUNTING SOFTWARE

BUSINESS COACHING & PLANNING

From entity selection and setup to developing a business plan that fits your unique scenario, our Client Advisory Services team is uniquely qualified to advise an owner of a new or expanding business.

- Organizational Structure Analysis

- Entity Selection & Setup

- Business Planning & Budgeting

- Feasibility Analysis

FORECASTING & BUDGET

Using historical data and trends, we outline expected revenues and expenses and allocate resources accordingly to keep you on track to meet your goals.

- Predictive Financial Analysis

- Create & Monitor Budgets

- Cash Flow Management

- Financial Modeling

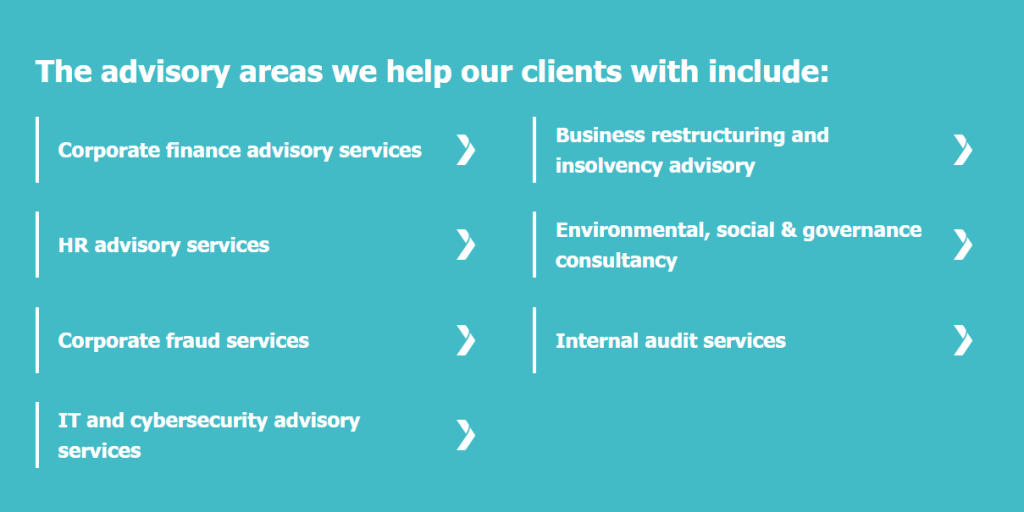

AUDIT & ASSURANCES

Having sound internal processes in place will help you remain compliant, improve functionality, and prevent the risk of legal or financial damages. We will thoroughly examine your organization’s internal control systems to determine the efficiency and effectiveness of your operating procedures.

- Review Engagements

- Internal Audit

- Audit of donor-funded projects

- IFRS Training and Technical Assistance

Internal audit & assurance

We offer partner-led audit and assurance services for both private and publicly traded entities. During our audits, we gain a real understanding of the quality and effectiveness of your accounting and control systems and work with you to ensure regulatory compliance for your business.

TFCCO is built on a foundation of audit quality, be they statutory, internal or any other type. We are focussed on providing our clients with high standards of reporting and technical knowledge from our teams across the globe.

We have a Global Quality Group that works closely with our Director of Quality and Professional Standards.

Strategic internal audit solutions for business growth

Internal audit is no longer solely about reviewing financial processes and controls. It plays a critical strategic role in identifying enterprise-wide risks, improving efficiency, and ensuring regulatory compliance. Our Internal Audit services provide businesses with the expertise to optimise operations, reduce costs, and enhance overall performance.

Our internal audit services

We offer a full range of internal audit solutions designed to support businesses in managing risk, improving governance, and driving operational excellence. Our services include:

Outsourced and co-sourced internal audit

Our experienced professionals provide flexible internal audit solutions to meet your business needs, including:

GENERAL ACCOUNTING SUPPORT

- Accounting Process Automation

- General Ledger Analysis

- Cash Flow Analysis

- Bank Reconciliation

- Financial Statement Preparation

- Accounting Software Set Up & Implementation

IT & CYBERSECURITY SERVICES

| Web development | |

| Product management | |

| IT Company | |

| Home data Analysis | |

| IT Solution | |

| Web Agency | |

| UIX / UX Design | |

| Claud Services | |

| Branding | |

| Startup company | |

| Flyers | |

| Software Company | |

| Pull up | |

| Business Development | |

| Bill Board | |

IT& Cybersecurity Advisory

At TFCCO, we offer expert IT and cybersecurity advisory services to help protect your business, ensuring compliance and resilience against ever-evolving risks.In today’s digital landscape, safeguarding your business from cyber threats is not just essential; it’s critical. The increasing complexity of cyber-attacks and the rising importance of data protection demands that businesses invest in robust IT and cybersecurity strategies.

With over 5 years of experience, TFCCO ‘s network of experts provides comprehensive cybersecurity solutions to businesses across various sectors. Our IT and cybersecurity advisory services are tailored to meet the specific needs of your business, offering the peace of mind that comes with knowing your organisation is equipped to tackle current and future digital threats. Reach out today to discuss how we can enhance your IT and cybersecurity strategy.

OUR IT & CYBERSECURITY ADVISORY

At TFCCO, we understand the complexities and challenges businesses face when it comes to securing their IT infrastructure. Our IT and cybersecurity services are designed to help organisations build strong, adaptive strategies to protect against cyber threats, safeguard valuable data, and ensure compliance with local and international regulations.

We offer the following services:

IT & CYBERSECIRTY RISK MANAGEMENT

Understand and mitigate the risks associated with your IT infrastructure to protect your business from cyber threats.

DIGITAL TRANSFORMATION AND AUTOMATION

Embrace digital change by automating processes and enhancing your IT systems for improved efficiency and security.

IT INFRASYRUCTURE & HUB SERVICES

Strengthen your IT foundation with scalable infrastructure solutions that support business continuity and growth.

WHY IS IT CYBERSECURITY IMPORTANT

As digital threats become increasingly sophisticated, businesses need to prioritise IT and cyber security to avoid costly data breaches, operational disruptions, and reputational damage. A comprehensive cyber security strategy not only protects your business from external threats but also ensures you comply with regulatory requirements and industry standards.

By proactively investing in IT and cyber security services, your business can:

- Prevent data breaches that could expose sensitive information.

- Safeguard business continuity with reliable incident response strategies.

- Build trust with customers, clients, and stakeholders by prioritising data protection.

- Mitigate the financial and operational risks of cyber-attacks.

- Achieve regulatory compliance to avoid penalties and legal challenges.

WHEN SHOULD AN ORGANISATION SEEK IT AND CYBERSECURITY ADVISORY SERVICES

In today’s digital world, there is no wrong time to enhance your cyber security strategy. However, some key events signal the need for expert IT and cyber security advisory services:

- Starting a new business: Set up robust IT and cybersecurity practices from the start to prevent future vulnerabilities.

- Expansion into new markets: Ensure your cybersecurity practices are compliant and secure across new jurisdictions and networks.

- Mergers and acquisitions: Assess the IT security posture of your partners to avoid inheriting their risks.

- Post-breach: If your business has already experienced a breach, seeking expert advice can help in managing the fallout and fortifying systems.

- Ongoing compliance requirements: Stay ahead of changing regulations and standards by proactively managing compliance.

- IT AND CYBERSECURITY FOR INTERNATIONAL EXPANSION

As businesses grow globally, securing IT systems across various markets becomes increasingly complex. For organizations planning international expansion, it’s crucial to have a consistent and robust cyber security strategy in place to protect against local and global threats.

At TFCCO, our global network of IT and cybersecurity professionals can help navigate the complexities of securing international operations. Our experts understand the specific cyber security challenges across different regions and work with you to ensure your business is protected and compliant, no matter where it operates.

WHAT ARE TFCCO’s COMPLIANCE STANDARDS FOR IT AND CYBERSECURITY?

As part of our commitment to delivering high-quality IT and cybersecurity advisory services, Kreston Global adheres to internationally recognised compliance standards. We ensure that all of our partner firms meet regulatory requirements and operate in accordance with the best practices in IT and cyber security.

- ISO/IEC 27001: Ensuring your business has a robust information security management system (ISMS).

- GDPR compliance: Providing guidance to ensure your organisation adheres to data protection laws and regulations, especially in the European Union.

- PCI DSS: Protecting payment data in accordance with the Payment Card Industry Data Security Standard.

- Local and international cyber laws: Kreston Global works with firms to ensure compliance with national and international cyber security regulations and best practices.

WHY CHOOSE TFCCO FOR IT AND CYBERSECURITY ADVISORY SERVICES

With our vast global network of experts, TFCCO offers unparalleled support for your IT and cyber security needs. Our extensive experience working with businesses of all sizes and industries gives us the insight and tools to protect your organisation against the latest cyber threats.

- Global reach: With a presence in 110 countries and a network of 6,500 professionals, TFCCO provides consistent, reliable services wherever you operate.

- Tailored solutions: We recognise that each business is unique. Our advisory services are designed to meet your specific needs, ensuring your IT security strategy is both effective and sustainable.

Expertise and experience: Our team has decades of experience in the field of IT and cyber security, providing cutting-edge solutions to safeguard your business.

CONTACT TFCCO TO SECURE YOUR IT INFRASTRUCTURE

Want to know more about our IT and Cyber Security Advisory Services? Find a firm today to discuss how we can protect your business and ensure compliance with the latest security regulations.

IT INFRASTRUCTURE

A modern, resilient IT infrastructure is the backbone of any successful business. At TFCCO, we provide a wide range of IT Infrastructure and Hub services that help businesses build robust systems, optimise workflows, and ensure seamless collaboration. Our IT services are designed to provide comprehensive support across multiple platforms, from cloud solutions to QA & testing.

OUR IT INFRASTRUCTURE SERVICES

TFCCO, offers tailored IT infrastructure services to help businesses optimise IT operations, improve collaboration, and enable future growth.

WHAT SERVICES DOES IT INFRASTRUCTURE SUPPORT INCLUDE

Our services cover a wide range of IT needs. Below are some of the key services we provide:

AGILE/WATERFAL PROJECT MANAGEMENT

We offer AGILE and WATERFAL project management methodologies to ensure your IT projects are delivered on time, within budget, and meet your business objectives.

CLOUD-TO-CLOUD INTEGRATION

We help businesses integrate cloud-based systems, enabling seamless data flow and improved collaboration between different platforms.

COLLABORATION TOOLS IMPREMENTATION

Our experts assist in selecting and implementing collaboration tools that enhance team communication, increase productivity, and streamline workflows.

VIRTUAL ASSISTANT SERVICES

We offer virtual assistant services to support business operations, providing automated solutions to manage repetitive tasks and boost productivity.

IT QA AND TESTING

Our quality assurance and testing services ensure that your IT systems and software perform as expected, are secure, and meet business requirements.

WHEN SHOULD AN ORGANISATION IMPLEMENT IT INFRASTURE SERVICES

It’s essential to adopt these services when your business is:

- Expanding operations and requires more robust IT infrastructure

- Moving to the cloud or enhancing cloud capabilities

- Looking to improve team collaboration and communication

- Implementing new IT systems or software

IT INFRASTURE & HUB SERVICES FOR INTERNATIONAL EXPANSION

TFCCO ’s IT infrastructure solutions are designed to support businesses expanding internationally, providing scalable, reliable IT systems that ensure smooth operations across borders.

WHAT ARE TFCCO’s COMPLIANCE STANDARDS FOR IT INFRASTRUCTURE?

We ensure that all our IT infrastructure services comply with global standards and regulatory requirements, providing businesses with secure, compliant systems wherever they operate.

WHY CHOOSE TFCCO FOR IT INFRASTURE SERVICES

With a global network of experts across 110 countries, Kreston Global delivers tailored IT infrastructure solutions to businesses worldwide, ensuring they stay competitive, secure, and efficient.

CONTACT TFCCO TO FIND OUT HOW WE CAN SUPPORT YOUR IT INFRASTRUCTURE SERVICES

Reach out to us today to explore how our IT infrastructure solutions can support your business.

PAYROLL SERVICES

HR & payroll outsourcing

HR & payroll outsourcing services are among our many domains of expertise at TFCCO. As with all of our outsourcing services, our teams are experienced in maintaining robust data security across the many countries that we work in. If you’d like to find out more about how we can help you in this area, get in touch to discuss your circumstances with us today.

Few jobs are as important as that of ensuring your employees receive their pay packages correctly and on time. Yet this task isn’t always the best use of your in-house finance team, whose efforts may be better placed on other important tasks. This is just one of the situations in which payroll outsourcing is an efficient solution.

Why outsource HR & payroll?

A smooth payroll process is crucial to keep your business running. Yet despite this, it can be a time-consuming and complex process. When you outsource payroll to a trusted team of experts, you can experience a number of advantages including, but not limited to, the following.

Have greater flexibility

Managing payroll is a time-consuming task, especially for larger organisations. Payroll outsourcing services can relieve your finance department of this responsibility, freeing up their time to focus on other strategic areas that help give you a marketplace edge. Moreover, outsourcing allows you to quickly scale your payroll processes as your business grows, without the need to recruit, train and manage additional in-house staff.

Minimise mistakes and ensure compliance

When you use payroll outsourcing services, you partner with specialists whose sole expertise is in this field. With this level of focus, the chances of mistakes are few and far between. Our global teams stay up to date on the regulatory changes occurring in their respective countries, meaning that you can be assured of minimal exposure to non-compliance risks.

Gain access to specialized knowledge

The level of expertise of any in-house payroll team will always be limited by its very nature. This is especially true if you are an international organisation but lack internal experience dealing with the payroll codes and regulations concerning the different countries in which you operate. With a network spanning more than 115 countries, we are able to find specialists with the knowledge you need to service payroll effectively across the globe. Moreover, our teams have experience working with businesses of all structures and sizes, and across all sectors.

The scope of our HR & payroll outsourcing services

Of course, payroll is not one single activity, but rather comprises a set of tasks executed in tandem with one another. We will always take the time to understand the unique circumstances of your organisation, so as to provide a bespoke outsourcing service that meets your needs. Following this, we will partner with you to deliver whatever your payroll process requires, including the following functions:

- Setting up employee accounts by securely processing their personal information

- Establishing and managing your company’s preferred payment method

- Handling payroll taxes

- Effecting applicable employee reductions

- Managing end-of-year tax return forms and declarations

Why choose TFCCO for HR & payroll outsourcing?

Are you considering outsourcing your organisation’s payroll? At TFCCO, we’re ready to help you. Our level of experience and knowledge in this area is exceptional and exceeded only by our commitment to delivering outstanding service.

As a global network, we appreciate that modern-day business requires 24-hour coverage. We’re proud to have a network of more than 120 independent firms worldwide that facilitates this need. No matter where you are, we’re able to use our payroll outsourcing expertise to free up your time to focus on more vital aspects of your business.

To find out more about how our outsourced payroll services could help you.. Use our map to find your nearest firm in our global network.

COMPANY SECRETARIAL SERVICES

DIRECTORSHIP SERVICES

WORK PERMIT APPLICATION

DE-REGISTRATION OF THE COMPANY

REGISTRATION OF THE COMPANY

ANNUAL RETURN FILING

- Business certificate of good standing

ACCOUNTING & BOOKKEEPING

ACCOUNTANCY SERVICES

TFCCO network of experts provides accountancy services that are essential for a growing business – both in your home country and abroad.

Whether you need help with management reporting, profit/loss statements and board reports, or assisting your finance team across multiple geographic locations TFCCO accountants are used for providing many different financial services to many different types of companies.

From GAAP reporting in multinational settings to local family-owned businesses, wherever in the world you are, you can rely on the close relationships between our member firms to give you the seamless and timely advice you need for your business’ international growth.

What accounting services do TFCCO offer?

Excellent accounting plays a crucial role in the management of a successful business. Our accounting specialists can support you with a range of financial services, to keep your business’ accounts running smoothly and ensure you stay abreast of any statutory compliance requirements.

GAAP financial statements

Local Generally Accepted Accounting Principles (GAAP) refer to the rules that are required to be followed in a specific country when filing financial statements. GAAP must legally be done by any publicly traded and regulated business. Without it, ramifications may come into play.

This method of reporting financial statements is done all over the world in accordance with local GAAP accounting rules. This ensures that a business’ finances are visible, consistent and comparable. When this is done, business owners and investors can see the overall health of a company.

Our GAAP financial statement services

At TFCCO, our international network of accounting professionals each excel in complying to their local financial reporting requirements through GAAP. We ensure that your business is able to meet the reporting standards of all the jurisdictions it operates within, keeping all bases covered with our cross-national consultants. Our partner firms have access to some of the best market research, deepening our understanding of a variety of sectors, ensuring that our financial reporting services meet the full needs of each client, identifying areas of improved efficiency and opportunities for growth.

What are GAAP financial statements?

GAAP stands for Generally Accepted Accounting Principles. These principles differ in each jurisdiction, meaning that it can be valuable for your business to consult an expert in the accounting regulations of your operating country. By adhering to GAAP regulations within financial reporting, you can ensure that your business is operating at a high standard of compliance and that your financial reporting is understandable and comparable for stakeholders and investors. By producing high quality and comprehensive financial reporting, businesses can better understand their strengths and weaknesses, communicate better with stakeholders and craft better informed business plans for growth.

Format for GAAP-compliant financial statements

When preparing financial statements in accordance with local GAAP, there are key requirements that must be observed for compliance. Whilst the specifics can vary from country to country, some elements remain consistent throughout. These are the five main principles of any GAAP reporting:

A statement of financial position at the end of the period

This statement includes a summary of financial balances within the business. At the end of a period, the business will show the assets, liabilities and equity of its operations. When this is done, the overall financial position of the business can be understood.

A statement of comprehensive income for the period

The second required financial statement under GAAP is a statement of comprehensive income. This highlights the income of a company whilst displaying expenses too. With this information, the net income for a specific period is visible.

A statement of changes in equity for the period

Local GAAP financial statements will also include changes made to the equity stakes in a business. This will summarise the transactions related to shareholders over a specific period.

A statement of cash flows for the period

Across the period, cash will flow in and out of the business. This is highlighted in this section and shows whether all the revenues on the income statement have been collected.

Notes containing a summary of significant accounting policies and other explanatory information

This final section will be found in the footnotes of your financial statement reporting. It will include additional information on the above statements and the policies your firm follows. This section provides context for your financial reporting and can be important for stakeholders to understand your company’s financial health.

Separate vs consolidated GAAP financial statements

When it comes to your reporting, there are two options available:

The first is consolidated financial statements in accordance with GAAP which refers to the reporting of the finances of two or more companies at the same time. This is done if a parent company has several subsidiaries and stakeholders want to see how the overall health of the company appears.

The second option is separate local GAAP reporting which is the financial reporting of just one business, be that the parent company or a subsidiary. This can be useful when an investor is looking to become a stakeholder in an individual business.

What is the difference between GAAP and IFRS financial statements?

Whilst GAAP reporting is localised and dictated by the country in which your business operates, IFRS (International Financial Reporting Standards) are requirements that are internationally recognised and essential for financial reporting to be comparable globally. Both GAAP and IFRS standards must be met within financial statements. Our accounting consultants provide expert advice in both IFRS and GAAP compliance and can support your organisation through all of its financial reporting needs.

Accountancy reporting services

TFCCO provides expert accountancy reporting services, including IFRS, and local GAAP financial statements, ensuring compliance and accuracy for international businesses. Accurate and compliant financial reporting is essential for businesses operating in multiple jurisdictions. Whether your company follows US GAAP, IFRS, or local GAAP standards, having precise financial statements ensures regulatory compliance, investor confidence, and strategic decision-making.

TFCCO’s extensive network of financial experts helps businesses understand complex accounting frameworks with clarity and precision. Our professionals provide tailored reporting solutions that align with global standards while addressing local regulatory requirements.

Our accounting & financial reporting services

TFCCO offers a comprehensive range of financial reporting services, ensuring businesses meet compliance obligations across different jurisdictions. Our services include:

US GAAP financial statements

For businesses operating in or reporting to the US, compliance with Generally Accepted Accounting Principles (US GAAP) is critical. TFCCO’s specialists provide accurate and timely financial statement preparation, ensuring adherence to SEC regulations, Financial Accounting Standards Board (FASB) standards, and industry best practices.

IFRS financial statements

International Financial Reporting Standards (IFRS) are widely used across the globe. TFCCO helps businesses transition to IFRS, prepare compliant financial statements, and deal with complexities related to international financial reporting.

GAAP financial statements

Each country has unique local GAAP requirements, which can vary significantly from IFRS or US GAAP. TFCCO supports businesses in preparing and reviewing financial statements that meet national accounting standards, ensuring compliance and transparency.

Why choose TFCCO for accountancy reporting?

Seamless cross-border support: Our international network enables smooth financial reporting for multinational companies.

Global expertise: Our professionals are well-versed in international and local financial reporting standards.

Tailored solutions: We provide customised reporting services that align with your industry and jurisdiction.

Compliance & accuracy: Ensuring financial statements meet all regulatory and legal requirements.

ELECTRONIC BILLING MACHINE (EBM) MANAGEMENT SERVICES

BUSINESS RESTRUCTURING AND INSOLVENCY ADVISORY

Financial distress can pose significant challenges for businesses and lenders, making proactive planning essential for stability and long-term success. Whether your organisation is facing market uncertainty, operational inefficiencies, or insolvency risks, TFCCO’s restructuring and insolvency experts provide the strategic support needed to navigate complex financial situations.

With decades of experience across global markets, our advisors help businesses restructure for recovery, assist lenders in insolvency proceedings, and guide stakeholders through challenging financial landscapes. We work closely with clients to create solutions that preserve value, mitigate risk, and position businesses for sustainable growth.

Our restructuring and insolvency services

At TFCCO, we offer a comprehensive range of restructuring and insolvency advisory services, supporting both businesses and lenders through financial challenges.

Services for corporates

Businesses experiencing financial distress, operational inefficiencies, or market downturns require expert support to regain stability. Our restructuring services for corporates include:

- Business restructuring advisory – Helping businesses adapt to financial and market challenges through strategic restructuring.

- Turnaround advisory – Implementing recovery strategies to improve cash flow, operational efficiency, and financial performance.

- Twilight zone advisory – Assisting businesses navigating the critical period before formal insolvency, ensuring compliance and exploring recovery options.

Services for lenders and creditors

Lenders and creditors impacted by insolvency proceedings need specialist guidance to protect financial interests and ensure compliance. Our advisory services include:

- Formal insolvency processes – Supporting liquidation and administration processes.

- Legal support for insolvency – Advising on insolvency proceedings where the primary professional is a lawyer.

- Creditor representation – Assisting creditors affected by the insolvency of trading partners.

- Accelerated M&A – Managing distressed asset sales and acquisitions.

- Independent business reviews – Conducting financial and operational assessments to support lenders’ decision-making.

Why choose TFCCO for restructuring and insolvency advisory?

With a presence in 110 countries and a global network of professionals, TFCCO offers deep expertise in financial restructuring, insolvency proceedings, and business recovery. Our approach is:

- Strategic – We focus on practical, results-driven solutions tailored to each client’s situation.

- Global – Our international network enables cross-border restructuring and insolvency support.

- Collaborative – We work closely with businesses, lenders, and legal professionals to ensure seamless execution.

Contact TFCCO for expert restructuring and insolvency support

If your business or financial institution requires restructuring and insolvency advisory services, TFCCO can help. Find the service today to discuss your needs.

Debt restructuring and insolvency services for corporates

Economic uncertainty, financial distress, and adverse market conditions can challenge even the strongest businesses. When facing financial difficulties, having a clear strategy can mean the difference between recovery and insolvency. At TFCCO, we provide expert restructuring and insolvency services to help businesses regain stability, manage risks, and position for future growth.

Our global network of specialists works with companies across industries, delivering strategic advice and practical solutions. Whether your business needs restructuring due to financial distress, a turnaround strategy, or guidance in the twilight zone of insolvency, TFCCO has the expertise to support you.

How TFCCO Supports Businesses in Debt Restructuring and Insolvency

We offer tailored solutions to help businesses address financial challenges, improve operational efficiency, and navigate insolvency risks.

Business Restructuring Advisory

When businesses face financial distress or operate in challenging market conditions, restructuring can provide a pathway to recovery. TFCCO’s business restructuring specialists assess financial health, identify inefficiencies, and develop restructuring strategies that optimise performance and preserve value.

Turnaround Advisory

If your business is experiencing financial distress but still has a viable future, a structured turnaround strategy can help restore stability. Our turnaround advisory services focus on improving cash flow, restructuring debt, and implementing operational changes to enhance financial performance.

Twilight Zone Advisory

Navigating the period between financial difficulty and formal insolvency—often referred to as the “twilight zone”—requires careful decision-making. TFCCO provides strategic guidance to businesses in this critical phase, helping directors fulfil their obligations while exploring options to avoid formal insolvency where possible.

Why Choose TFCCO for Restructuring and Insolvency Advisory?

With over 5 years of experience supporting businesses through financial challenges, TFCCO delivers practical, results-driven solutions. Our global network provides:

- Expertise in business restructuring and turnaround strategies

- Support in managing financial distress and adverse market conditions

- Guidance in navigating the twilight zone of insolvency

- A collaborative, strategic approach to recovery and long-term growth

Contact TFCCO for expert Restructuring and Insolvency Support

Want to learn more about how TFCCO can support your business with restructuring and insolvency services? Get in touch with our expert advisors today.

ENVIRONMENTAL & SOCIAL CONSULTANCY

ESG stands for environmental Social and Governance and it refers to a set of criteria used to evaluate an organisation’s performance and impacts in these three areas. ESG criteria are used to make the sustainability efforts of an organisation measurable and quantifiable.

Sustainability is the framework to make an organisation responsible in a number of areas, such as its environmental impacts, human rights and community issues, labour and operating practices, client processes and organisational governance. Responsible and ethical practices can sustain the long-term health and well-being of the organisation, the planet and its people.

It’s no secret that it’s a world of new priorities for businesses that is dynamic and shaped by many different factors besides profit. The list includes:

- increased demand for diversity, equity and inclusion (DEI) in the workplace;

- transparent and accountable governance structures;

- mitigating climate change-related impacts that lead to increased operational and insurance costs; and

- embracing circular economy principles, due to increased demand for sustainable organisations, products and services from clients.

If you don’t embrace this new business reality and adapt as an organisation, you will endanger your long-term survival and put your clients at risk.

There are many benefits of taking organisational action on ESG, which include:

- achieving regulatory compliance, avoiding fines and reputational damage;

- improved risk management, so that you can identify all relevant risks and opportunities linked to ESG issues;

- promotion of innovation and operational efficiencies by identifying areas of inefficiency, enhancing productivity and reducing operating costs;

- addressing stakeholder expectations, which are increasingly becoming more important, beyond just shareholders and investors, providing the organisation with a social license to operate;

- accessing more capital at more favourable terms, and gaining a competitive advantage in the marketplace; and

- attracting and retaining high-calibre employees and loyal customers.

All of these reasons can help create long-term value for your brand, a global reputation that can positively influence relationships with government bodies, partners, NGOs, etc., improve returns and give rise to new growth opportunities. Embedding ESG in the organisation’s operations, ethos and culture is more than a compliance tick box exercise, it’s a new way of being for companies who wish to be resilient and remain competitive in the marketplace.

Our ESG consulting services

Our firms can help you at any stage of your ESG journey, whether you are just starting out or you’re further advanced.

Our services include:

- ESG reporting, compliance with regulation and assurance

- ESG strategy development (including gap analysis and materiality assessments), climate change risk assessment and stakeholder engagement

- Circular economy practices (carbon, waste, energy and resource management) to achieve net zero

- Sustainability standards and policies, ESG training, and executive coaching

- Sustainability supply chain management

- Sustainable finance and responsible investment advisory

- Social impact assessment and diversity, equity, and inclusion (DEI) strategy

We can support you in your ESG reporting and other legal requirements, whether you’re based in the EU, North America, Latin America, Asia Pacific, the Middle East, or Africa. We can also provide assurance services for your existing sustainability or ESG report, as prescribed by key legislation such as the EU’s Corporate Sustainability Reporting Directive (CSRD).

We work with you to develop an ESG or net zero strategy by conducting climate change-related risk assessments, gap analyses, and double materiality assessments. We also engage your stakeholders to establish a baseline and work towards improving your performance.

Our firms assist in implementing circular economy practices across energy, waste, carbon, and resource management to enhance efficiencies, reduce costs, and support your net zero journey.

We provide ESG training for employees and executive coaching for senior management, alongside implementing sustainability standards and policies such as the GRI Standards, Task Force on Climate-Related Financial Disclosures (TCFD), UN Sustainable Development Goals (UN SDGs), CDP, various ISO standards, and more.

We also support sustainability supply chain management by optimising ESG performance and mitigating risks within your supply chain.

ESG reporting

We ensure your organisation’s environmental, social, and governance (ESG) practices are accurately reported, fully compliant with relevant regulations, and independently verified. Our services enhance transparency and build stakeholder trust.

ESG strategy development

We develop tailored ESG strategies that align with your organisation’s values and goals. Through gap analysis and materiality assessments, we identify critical ESG issues, assess climate risks, and engage stakeholders to prioritise and address sustainability challenges effectively.

Circular economy

We help embed circular economy principles into your operations, focusing on reducing carbon emissions, minimising waste, and optimising resource use. Our approach supports your journey to net zero, ensuring long-term resilience and sustainability.

Sustainability standards and policy development

We guide you in establishing robust sustainability standards and policies that meet international benchmarks. Our ESG training and executive coaching equip leadership with the expertise needed to drive ESG initiatives forward.

Sustainability supply chain management

We help integrate sustainability principles into your supply chain, ensuring operations minimise environmental impact, enhance social responsibility, and comply with ESG standards.

Sustainable finance and responsible investment advisory

We support organisations in integrating ESG principles into financial decision-making, helping businesses align their investment strategies with sustainability objectives, green financing, and responsible investment practices.

Social impact assessment and diversity, equity, and inclusion (DEI) strategy

We provide social impact assessments to measure your organisation’s influence on communities and society. Our DEI strategies help foster inclusive workplaces, ensuring fair representation and equitable opportunities for all.

What are TFCCO’s environmental, social, and governance standards?

Our experts track ESG standards globally as they evolve, ensuring our services align with the latest developments.

Depending on your region, your firm may be subject to different ESG legislation. The European Union currently has the most advanced legal framework, with key legislation such as:

- Corporate Sustainability Reporting Directive (CSRD)

- EU Taxonomy

- Sustainable Finance Disclosure Regulation (SFDR)

- Corporate Sustainability Due Diligence Directive (CSDDD)

However, other regions, including North America, Latin America, Asia Pacific, the Middle East, and Africa, are also enacting ESG-related regulations. Our global network ensures you receive region-specific support tailored to your compliance needs.

Understanding which requirements apply to you is the first step. Factors such as company size (employees, turnover, assets, IPO status) will determine your ESG reporting obligations. Our ESG advisors can help clarify legal obligations and voluntary frameworks best suited to your sector and industry.

Why choose TFCCO’s ESG services?

TFCCO’s network firms are ideally positioned to support your ESG journey. Our seasoned ESG experts bring years of practical experience across public and private sectors and multiple industries.

We support businesses at all ESG maturity levels—from those just beginning to assess their impact to organisations with established sustainability practices. Our firms maintain the highest professional standards and actively integrate ESG principles into their operations, with many achieving certifications that reflect their commitment to sustainability.

Whether you are a small or medium-sized enterprise or a multinational corporation, we leverage our global network to provide local expertise and tailored ESG solutions that meet your specific needs.

BILLING AND RECOVERY SERVICES

- Debt advisory

Advising on structuring and securing optimal debt financing solutions.